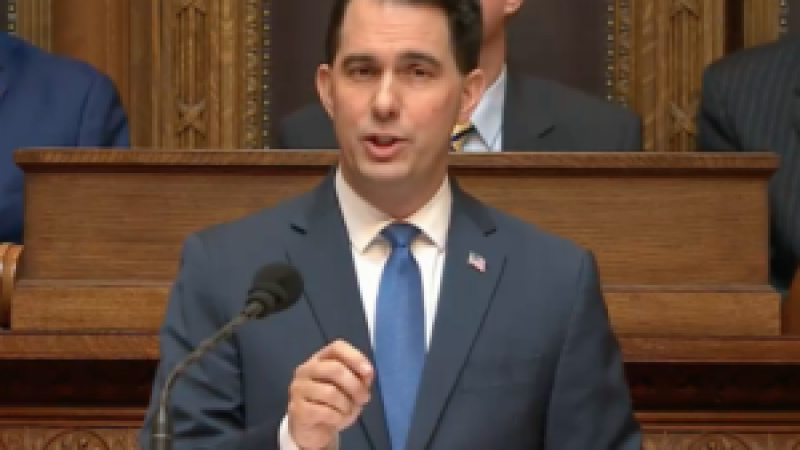

Gov. Scott Walker used his veto pen to extend the August sales tax holiday from two to five days.

In a partial veto message the guv issued after signing into law the $100-per-child tax rebate and sales tax holiday Tuesday, Walker wrote that holding the holiday for two days "may deny hardworking taxpayers with children the chance to take advantage of this sales tax holiday."

Instead, the sales tax ...

Please log in to access subscriber content.

If you don't have a subscription, please contact schmies@wispolitics.com for subscription options on the WisPolitics-State Affairs platform, which is the new home for WisPolitics subscriber products.