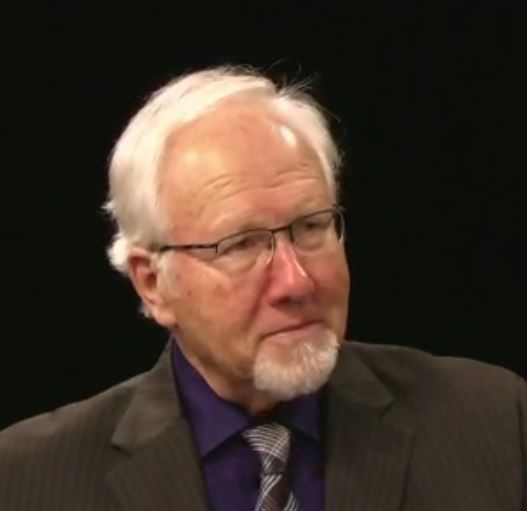

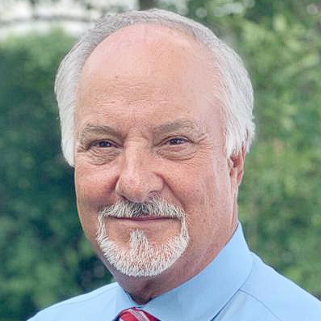

Bill Barth: Time for a revolution of the rational

I’m tired of tolerating radical right-wingers or left-wingers who belligerently want to tell me and everybody else what to think … We are broken because the few have appointed themselves to speak for the many and the rest of us have let them get away with it.