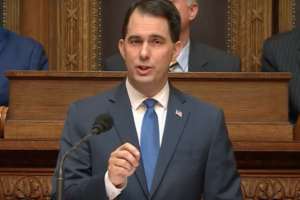

James Rowen: Walker’s soft landing in the heart of the welfare state

Walker’s announced punt out of Wisconsin politics in 2021 leaves him plenty of time to change his mind – – but he says he’s off to run a youth-oriented right wing foundation in suburban Virginia near DC and turn America’s young people away from socialism.